The Tokyo Senior HR Executive Market: A Comprehensive Analysis of Leadership Talent in Japan's Multinational Corporations

The senior HR executive market in Tokyo is experiencing significant transformation driven by demographic shifts, technological advancements, and evolving corporate priorities. While Japanese companies continue to adapt their human capital strategies to compete globally, they face unique challenges in attracting and retaining top HR leadership talent. This analysis examines the current state of the HR executive landscape in Tokyo, with particular emphasis on multinational corporations, revealing a complex interplay of factors shaping this specialized segment of the labor market. The research highlights a significant talent shortage at the executive level, substantial compensation disparities between Japanese and Western companies, and growing emphasis on digital transformation capabilities within HR leadership roles.

Market Dynamics for Top-Tier HR Talent in Tokyo

The executive search market in Japan, including for senior HR positions, remains in a relatively immature state compared to other global markets, having existed for a significantly shorter period than in regions like North America and Europe. This market immaturity creates unique challenges for companies seeking to fill leadership positions in Tokyo's competitive business environment. A critical issue facing organizations is an unprecedented shortage of executive and leadership talent, particularly in specialized functions like human resources, which stems largely from inadequate succession planning practices within Japanese corporations. This talent gap has been exacerbated by the COVID-19 pandemic, which created numerous leadership vacancies as companies were forced to manage Japanese operations remotely from overseas headquarters.

The broader demographic challenges facing Japan are directly impacting the HR executive market. Japan is gradually transforming into what experts describe as a "limited labor-supply society," with demographic statistics projecting a continuous growth in the elderly population until 2044, while simultaneously experiencing a rapid decline in the working-age population until 2040. This demographic shift creates a structural and chronic shortage of labor that extends to the executive level across all functions, including human resources. The situation requires HR leaders with sophisticated strategies for talent management in an increasingly constrained labor market, making such professionals even more valuable and harder to secure.

Human Resource officers in Japan are actively grappling with the challenge of adapting their hiring strategies to remain competitive in the face of growing pressure from global competitors. Chief Human Resources Officers (CHROs) from major Japanese firms such as Fujitsu, Panasonic, Marubeni, KDDI and OMRON have openly acknowledged the importance of investing in their people while simultaneously recognizing the significant difficulties in implementing effective human capital strategies. This consensus among industry leaders underscores the complex market dynamics for HR talent in Tokyo, where demand for strategic HR leadership continues to grow while the supply of qualified candidates remains constrained.

HR Leadership Dynamics Across Different Industries

The technology sector in Japan demonstrates a particularly diverse and specialized approach to HR roles, as evidenced by Rakuten's extensive HR department structure. Within this major e-commerce and technology company, HR positions span specialized functions including talent acquisition, employee relations, organizational optimization, HRIS (Human Resource Information Systems) management, and dedicated training and development roles. This sophisticated segmentation reflects the tech industry's need for HR leadership that can support rapid innovation while managing the unique challenges of attracting and retaining technical talent in a competitive market. The presence of specialized roles such as "Business Skills Trainer and Consultant" and "Talent Management Specialist" indicates the strategic importance tech companies place on developing human capital as a competitive advantage.

In contrast, traditional manufacturing and telecommunications sectors in Japan appear to be placing increased emphasis on transformational HR leadership. Companies like Fujitsu, Panasonic, and KDDI are actively seeking HR executives who can drive cultural change while balancing traditional Japanese business practices with global best practices. These industry leaders recognize that maintaining competitiveness requires fundamental changes to their people strategies, particularly as they expand their global operations. The manufacturing sector faces additional HR challenges related to automation and aging workforces, requiring HR leadership with change management expertise and strategic workforce planning capabilities.

Multinational companies operating in Japan represent a distinct segment within the market, with 80-90% of executive search clients being foreign capital companies headquartered outside of Japan. These organizations typically require HR leaders who can successfully navigate the intersection of Japanese business culture and international corporate practices. English language proficiency is consistently described as a necessity for these roles, while Japanese language skills represent a significant advantage but are not always mandatory. This creates a rather narrow candidate pool of bicultural, bilingual HR professionals who understand both Japanese employment practices and global HR standards.

Recent Trends in HR Leadership Roles at Multinational Companies

Digital transformation has emerged as a central focus for HR leadership roles in Japan, with companies increasingly seeking HR executives who can leverage technology to enhance workforce productivity and strategic capabilities. Tokyo Century, for example, has positioned digital transformation as a cornerstone of strengthening its management base and driving innovation in its corporate culture and business model. The company established a dedicated DX Strategy Division in December 2020 and has been advancing initiatives that include harnessing digital technology to enhance corporate value and bolster competitiveness. This trend requires HR leaders with technological fluency and change management expertise who can drive digital adoption throughout the organization.

The COVID-19 pandemic has fundamentally altered leadership dynamics in multinational companies operating in Japan. Many leadership positions remained vacant locally during the pandemic, with companies forced to manage their Japanese teams remotely from overseas headquarters. In some extreme cases, expatriate executives on typical three-year rotational assignments never physically relocated to Japan during their entire tenure 1. While these restrictions have eased with the loosening of pandemic-related travel constraints, they have accelerated the adoption of remote and hybrid work models, requiring HR leaders to develop new approaches to talent management, engagement, and organizational culture in distributed work environments.

Human capital management has become a strategic priority for HR leaders in Japan, with CHROs from major Japanese firms actively discussing how to evolve their people strategies to remain competitive. This represents a shift from traditional Japanese HR practices focused primarily on administrative functions toward more strategic approaches that view human capital as a critical driver of organizational performance. The growing emphasis on human capital management requires HR executives with strong business acumen who can align workforce strategies with broader corporate objectives and demonstrate the ROI of people-related investments to senior leadership.

Competitiveness and Retention Challenges in the HR Executive Market

The scarcity of qualified HR leadership talent in Tokyo has created a highly competitive environment where strong candidates frequently receive competing offers. While specific counteroffers data isn't provided in the search results, the documented "unprecedented lack of executive and leadership level talent" strongly suggests that companies must be prepared for bidding wars when pursuing top HR candidates 1. Organizations that fail to move quickly in the hiring process or that present uncompetitive offers risk losing candidates to more agile competitors, particularly multinational corporations with greater compensation flexibility.

The combination of demographic pressures and increasing demand for specialized HR expertise creates a sellers' market for experienced HR executives with international exposure. This market dynamic places additional pressure on companies to develop comprehensive retention strategies for their HR leadership talent. While not specific to HR roles, we can observe that Japanese companies are increasingly recognizing that their traditional compensation approaches may be insufficient for retaining top talent. The movement toward more aggressive incentive structures among leading Japanese firms suggests an evolving approach to executive retention that places greater emphasis on performance-based rewards.

Companies are counteracting talent bottlenecks through various approaches, including repatriating Japanese talent from overseas to fill leadership roles. This strategy leverages professionals who have gained international experience while maintaining cultural ties to Japan, creating a valuable talent pool for HR leadership positions that require both global perspective and local knowledge. The success of repatriation efforts depends significantly on companies' ability to provide compelling value propositions that address both professional aspirations and personal considerations, as these candidates often have multiple options in global markets.

Challenges in Sourcing Exceptional HR Talent for Leadership Positions

The fundamental challenge in sourcing exceptional HR talent for leadership positions in Tokyo stems from Japan's demographic realities. With the working-age population declining rapidly until 2040, the overall pool of available talent is shrinking, creating competitive pressure across all executive functions. This demographic constraint is particularly acute for specialized roles like HR leadership, where candidates must possess both technical expertise and strategic business capabilities. Companies must develop increasingly sophisticated talent strategies to identify and attract qualified candidates in this constrained market.

Language barriers and cultural differences represent significant obstacles in the HR executive search process. For multinational companies, English language proficiency is typically a non-negotiable requirement, while Japanese language skills are highly valued but not always mandatory. This bilingual requirement substantially narrows the candidate pool, particularly for positions requiring both languages at business proficiency levels. Cultural fit presents an additional challenge, as HR leaders must effectively bridge Japanese business practices with global corporate expectations, requiring nuanced understanding of both contexts and the ability to navigate potential conflicts between them.

The executive search practice in Japan remains relatively underdeveloped compared to other markets globally, creating additional sourcing challenges 1. Many international search firms have attempted to enter the Japanese market but have struggled to adapt their approaches to the unique talent landscape of Japan. These firms have often overpromised results without fully understanding the local context, leading to disappointing outcomes for clients. This situation highlights the importance of working with search partners who possess deep knowledge of the Japanese HR executive market and maintain extensive networks within this specialized community.

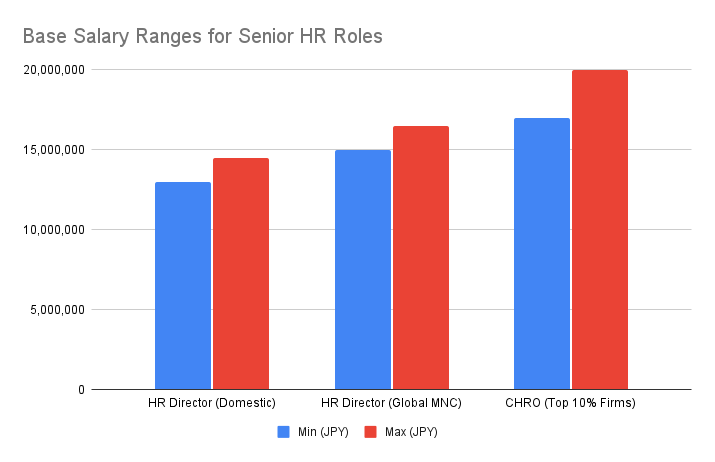

Salary Ranges and Compensation Structures for Senior HR Positions

Senior HR executives in Tokyo, including roles such as Chief Human Resources Officers (CHROs), HR Directors, and Talent Management Heads, experience compensation trends that mirror Japan’s executive pay landscape while reflecting the strategic value of HR leadership. Although granular data for HR-specific roles is limited, benchmarks from senior management provide insight. Base salaries for HR leaders in Tokyo typically range between ¥13,000,000 to ¥14,500,000 annually, with top performers in transformative or global HR roles earning ¥15,000,000 to ¥16,500,000. Total compensation often includes HR-specific incentives tied to talent outcomes, such as retention rates, succession planning success, or diversity metrics, alongside traditional benefits like housing allowances or retirement contributions.

Japanese vs. Western HR Compensation Practices

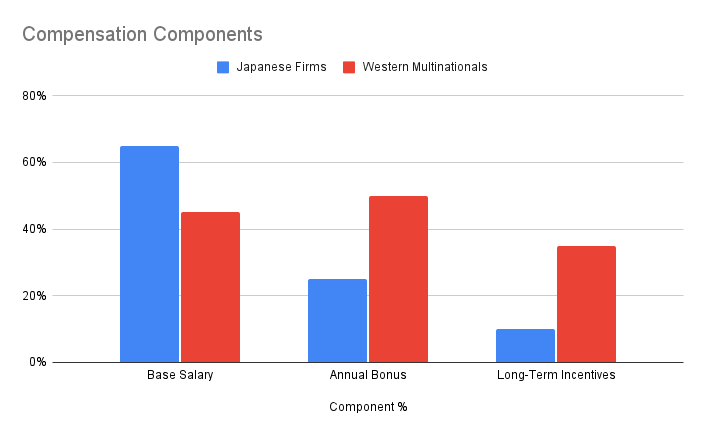

A notable gap persists between Japanese firms and Western multinationals (MNCs) in structuring HR executive pay. Japanese companies historically prioritize fixed salaries, with bonuses averaging 20–30% of base pay for HR roles, compared to Western MNCs, where performance-linked incentives (e.g., achieving workforce scalability goals or digital transformation milestones) may constitute 40–60% of total compensation. Long-term incentives (LTIs) like stock options or deferred bonuses, common in Western HR packages, remain underutilized in domestic firms but are gaining traction for roles requiring global expertise.

Implications for HR Talent Strategy

To attract and retain HR leaders capable of driving organizational transformation, Japanese firms are increasingly mirroring Western incentive models. This includes embedding “clawback” clauses for missed targets or weighting LTIs toward multi-year talent goals. For global HR roles, compensation packages may also include expatriate benefits, international relocation support, or language allowances, reflecting the growing premium on HR executives with multinational experience.

Comparison of HR Executive Compensation Between Japanese and Foreign Companies

A notable disparity exists in executive compensation structures between Japanese companies and their foreign counterparts operating in Tokyo. Japanese firms traditionally offer more conservative packages with a greater emphasis on base salary and less on variable components. In contrast, Western companies typically provide more aggressive compensation packages with significant performance-based elements 8. This difference extends to HR executive roles, creating a competitive advantage for foreign companies in attracting top talent, particularly professionals with international experience who have been exposed to Western compensation practices.

The performance gap between Japanese and Western companies appears to mirror the compensation differentials. When considering median capital return metrics, Japanese companies lag behind their U.S. and European counterparts in ROE (Return on Equity), with Japan reporting 9.85% compared to 16.64% for U.S. companies and an average of 11.35% for European firms. This performance differential suggests a potential correlation between compensation approaches and corporate results, with more aggressive performance-based pay potentially driving stronger financial outcomes. For HR executives specifically, this correlation indicates that roles at Western firms may offer greater earning potential through performance incentives.

Cultural factors contribute significantly to these compensation disparities. Japanese business culture traditionally places greater emphasis on job security, seniority, and collective performance rather than individual achievements and variable pay. However, leading Japanese companies are increasingly adopting elements of Western compensation models, particularly those competing globally for talent. This evolution suggests a gradual convergence of compensation practices, though significant differences are likely to persist due to deeply embedded cultural values and corporate governance norms in Japan.

Impact of Japan's Aging Workforce on HR Leadership Roles

Japan's demographic transformation is fundamentally reshaping HR leadership priorities and challenges. The elderly population is projected to continue growing until 2044, while the working-age population will decline rapidly until 2040 6. This shift creates a structural and chronic shortage of labor that HR leaders must address through innovative workforce strategies. The elderly population's high dependence on labor-intensive essential services such as nursing care, logistics, and medical care will maintain high labor demands until the early 2040s, further straining the available talent pool. HR executives must develop comprehensive approaches to workforce planning that account for these demographic realities.

Regional disparities in labor supply present additional challenges for HR leaders. Projections indicate that all regions of Japan except Tokyo will face serious labor-supply shortages. Tokyo's high concentration of government agencies, decision-making bodies, and major corporations is expected to sustain labor demand from 2030 to 2040, potentially masking the significant labor shortages experienced throughout the rest of the country. HR executives must develop region-specific strategies that address these varying labor market conditions, particularly for organizations with operations across multiple Japanese locations.

The aging workforce necessitates fundamental changes to traditional Japanese HR practices. HR leaders must champion more inclusive policies that extend working lives, accommodate diverse working arrangements, and leverage technology to enhance productivity. They must also drive

cultural change within their organizations, challenging traditional age-based hierarchies and promoting merit-based advancement. These initiatives require HR executives with change management expertise who can navigate the complex intersection of business needs, employee expectations, and cultural norms in a rapidly evolving demographic landscape.

Skills and Qualifications Most in Demand for Senior HR Positions

Bilingual capabilities remain a critical requirement for senior HR roles in multinational companies operating in Tokyo. English is consistently described as a necessity for these positions, while Japanese language skills represent a significant advantage. This language requirement reflects the need for HR leaders to communicate effectively with both global headquarters and local employees, bridging potential cultural and linguistic gaps. The limited pool of professionals with business-level proficiency in both languages creates competitive pressure for companies seeking to fill HR leadership positions.

Digital transformation expertise has become increasingly valuable for HR leadership roles. Companies are seeking HR executives who can leverage technology to enhance workforce productivity, improve talent management processes, and provide data-driven insights to business leaders. This requires not only technical understanding of HR information systems but also the strategic vision to reimagine HR functions through a digital lens. Tokyo Century, for example, has established specific management goals related to improving productivity through innovation, applying RPA (Robotic Process Automation) and expanding teleworking capabilities. HR leaders with experience implementing such initiatives are particularly sought after in the current market.

Strategic business partnership capabilities distinguish exceptional HR leaders from their peers. Modern HR executives are expected to function as true business partners rather than administrative function heads, actively contributing to organizational strategy and demonstrating the impact of people initiatives on business outcomes. This requires strong financial acumen, analytical capabilities, and the ability to communicate effectively with C-suite executives. HR leaders who can quantify the ROI of human capital investments and align workforce strategies with business objectives are especially valuable in the competitive Tokyo market.

Strategies Companies Are Using to Attract and Retain Top HR Talent

Forward-thinking companies in Tokyo are counteracting talent bottlenecks by leveraging their global networks to repatriate Japanese talent from overseas 1. This approach targets professionals who have gained valuable international experience while maintaining cultural connections to Japan, creating an ideal candidate profile for HR leadership roles in multinational organizations. Successful repatriation strategies typically involve compelling value propositions that address both professional opportunities and quality of life considerations, recognizing that these candidates often have multiple options globally.

Data-driven talent strategies are becoming increasingly important for identifying and securing HR leadership talent. Organizations are using workforce planning approaches to forecast talent demand based on business needs and growth plans, while simultaneously assessing talent supply based on current and potential candidates, their skills, availability, and retention patterns. These analytical approaches enable companies to create talent pipelines, prioritize critical roles, optimize recruitment and retention processes, and measure performance outcomes. For HR leadership positions specifically, such data-driven approaches help organizations identify high-potential candidates early and develop targeted attraction strategies.

Market research provides companies with critical insights into the competitive landscape for HR talent, helping them design more effective acquisition and retention strategies. This research reveals what skills and roles are most sought after by employers, prevailing salary and benefits standards, common challenges in talent acquisition, and candidate expectations and preferences 2. By understanding these market dynamics, organizations can position themselves more effectively as employers of choice for HR leadership talent, highlighting their unique value propositions and addressing potential concerns proactively.

Conclusion

The market for senior HR executives in Tokyo presents a complex landscape shaped by demographic challenges, cultural factors, and evolving business needs. The unprecedented shortage of executive talent, particularly in specialized functions like human resources, creates significant competitive pressure for companies seeking to fill leadership positions. This situation is further complicated by the structural constraints of Japan's aging population and declining workforce, which are fundamentally reshaping labor market dynamics across all sectors and functions.

Japanese companies face particular challenges in competing with foreign multinational corporations for top HR talent. The significant disparities in compensation structures and amounts between Japanese and Western firms create competitive advantages for foreign companies, though leading Japanese organizations are gradually adopting more performance-oriented pay practices to attract and retain exceptional leaders. The success of these efforts will likely depend on companies' ability to blend global best practices with respect for Japanese business culture, creating value propositions that resonate with highly sought-after bilingual, bicultural HR professionals.

Looking forward, the HR executive market in Tokyo will continue to evolve as companies adapt to demographic realities, technological advancements, and changing employee expectations. Organizations that develop sophisticated, data-driven approaches to talent acquisition and retention, invest in leadership development, and create compelling employee value propositions will be better positioned to secure the HR leadership talent they need to navigate these complex challenges. For HR professionals themselves, the constrained talent market presents significant opportunities for career advancement and impact, particularly for those who develop the strategic business partnership capabilities and digital transformation expertise most valued in today's market.

Citations

- https://www.roberthalf.com/jp/en/insights/hiring-help/what-state-executive-search-market-japan

- https://www.linkedin.com/advice/0/what-methods-can-you-use-analyze-talent-supply

- https://corporate-blog.global.fujitsu.com/fgb/2023-04-20/01/

- https://www.morganmckinley.com/jp/salary-guide/data/external-audit-assurance--senior-manager/tokyo

- https://japan-job-en.rakuten.careers/category/search-jobs/31066/79165/1

- https://recruit-holdings.com/en/blog/post_20230926_0001/

- https://www.tokyocentury.co.jp/en/business/innovation/dx.html

- https://www.wtwco.com/en-gb/insights/2025/01/the-ceo-pay-landscape-in-japan-the-us-and-europe

- https://www.mhlw.go.jp/content/11909500/001355793.pdf

- https://www.morganmckinley.com/jp/article/should-i-make-counter-offer-employee

- https://www.morganmckinley.com/jp/salary-guide/data/compensation-benefits-head-of-director/tokyo

- https://www.cirje.e.u-tokyo.ac.jp/research/dp/2003/2003cf199.pdf

- https://www.hays.co.jp/en/job-detail/senior-hr-operation-c-b-manager-inner-tokyo_1116660

- https://inside.ai/en/news/2022/08/02/ai-researchresults-2/

- https://www.chuo-u.ac.jp/english/features/2024/08/72676/

- https://www.morganmckinley.com/jp/salary-guide/data/hr--hr-director/tokyo

- https://bi.titanconsulting.jp/the-hr-perspective-comparing-global-and-domestic-companies-in-japan/

- https://www.hays.co.jp/en/job-detail/senior.-hr-manager-(head-of-hr)--inner-tokyo_1115891

- https://scalingyourcompany.com/hr-jobs-in-japan-for-foreigners/

- https://www.reddit.com/r/japanlife/comments/1cldyah/are_foreign_companies_%E5%A4%96%E8%B3%87%E7%B3%BBreally_that_different/

- https://builtin.com/jobs/as/japan/tokyo/hr/search/hr

- https://www.michaelpage.co.jp/en/jobs/human-resources/tokyo

- https://www.rgf-professional.jp/en/insights/2021-02-hiring-job-seekers-an-analysis-of-the-talent-landscape-in-japan

- https://www.chapmancg.com/chapmancg/is-japanese-hr-talent-becoming-more-desirable-for-regional-hr-positions

- https://www.morganmckinley.com/jp/salary-guide/data/hr--compensation-benefits-manager/tokyo

- https://www.morganmckinley.com/jp/jobs/tokyo/hr-lead-recruitment-hrbp-tech-industry/1091364

- https://www.hays.co.jp/en/blog/leadership/2024-human-resources-recruitment-trends-in-japan

- https://japanintercultural.com/free-resources/articles/japanese-firms-moving-towards-global-hr-practices/

- https://www.michaelpage.co.jp/en/salary-comparison-tool/senior-hr-manager-salaries

- https://www.morganmckinley.com/jp/jobs/discipline/hr-jobs

- https://www.weforum.org/stories/2024/08/how-companies-are-addressing-workforce-shortages-through-senior-employment-in-japan/

- https://www.roberthalf.com/jp/en/insights/hiring-help/5-reasons-why-counteroffers-dont-work-way-you-think-they-do

- https://www.works-i.com/english/item/FuturePredictions2040_JP.pdf

- https://www.cio.com/article/3600617/how-mitsui-co-cultivates-a-digital-first-culture-to-transform.html

- https://www.pedersenandpartners.com/news/executive-compensation-europe-and-us-versus-japan-forbes-japan

- https://www.hr-brew.com/stories/2023/02/17/world-of-hr-japan-invests-in-reskilling-to-accommodate-a-changing-population

- https://www.linkedin.com/pulse/why-counteroffers-horrible-retention-strategy-what-do-amy-volas

- https://www.michaelpage.co.jp/en/job-detail/demand-supply-planning-senior-manager/ref/jn-012025-6641354

- https://www.linkedin.com/pulse/human-resources-japan-2020-impact-digital-future-work-gary-schrader

- https://www.iss-corporate.com/library/japans-executive-pay-increasingly-mirroring-european-models/

- https://hrmasia.com/ageing-business-leaders-pose-succession-challenges-in-japan/

- https://www.robertwalters.co.jp/en/insights/news/blog/2021-12.html

- https://www.roberthalf.com/jp/en/job-details/hr-director/japan

- https://www.robertwalters.co.jp/en/insights/career-advice/blog/gaishi-nikkei-hikaku.html

- https://asia.nikkei.com/Opinion/Japanese-companies-need-to-meet-foreign-workers-halfway

- https://www.salaryexpert.com/salary/job/global-hr-director/japan/tokyo

- https://www.jil.go.jp/english/JLR/documents/2013/JLR37_hirano.pdf

- https://jp.linkedin.com/jobs/global-head-human-resources-jobs

- https://www.michaelpage.co.jp/en/jobs/executive-search/tokyo

- https://www.robertwalters.co.jp/en/expertise/human-resources/jobs-in-tokyo.html

- https://scalingyourcompany.com/hr-in-japan-top-5-tips/

- https://www.michaelpage.co.jp/en/jobs/hr-manager/japan

- https://www.tokyocentury.co.jp/tc-news-en/dx/dx-human-resource-development/

- https://www.nippon.com/en/japan-data/h02049/

- https://www.michaelpage.co.jp/en/jobs/head-hr/tokyo