The Strategic Cost of Leadership Vacancy in Japan: A Revenue Recovery Framework for Multinational Corporations

The operational stability of multinational corporations (MNCs) in Japan is currently facing a dual-pronged crisis: a demographic collapse that has reduced the pool of available leadership talent to historic lows and a traditional recruitment paradigm that fails to account for the catastrophic financial hemorrhage caused by unfilled executive roles. As of mid-2025, the Japanese labor market is characterized by an unemployment rate of approximately 2.5%, a figure that masks a much more severe shortage of bilingual, high-caliber professionals capable of navigating the complex intersection of global corporate strategy and local market execution.1 Within this context, a vacancy in a critical leadership position—such as a Country Manager, Sales Director, or Finance Director—is often viewed through the narrow lens of "saved salary" rather than the more accurate and alarming lens of "revenue loss."

To maintain competitive parity in one of the world’s most sophisticated and relationship-driven markets, MNCs must transition toward a "Revenue Recovery" model of recruitment. This framework shifts the perspective of talent acquisition from a back-office administrative function to a front-line revenue protection tool. For positions that remain vacant for over six months, the financial and hidden costs—including team burnout, turnover risk, and the erosion of brand equity—frequently exceed the annual salary of the role itself by a factor of three or more.4 The following analysis provides a comprehensive diagnostic of the current Japanese executive talent landscape, quantifies the direct and indirect costs of leadership voids, and offers a strategic roadmap for shortening the hiring cycle to a 90-day target.

The Macroeconomic Context of Executive Scarcity in Japan

The difficulty of recruiting for senior-level roles in Japan is not a transient byproduct of global economic cycles but the result of permanent structural shifts. The working-age population is shrinking at an unprecedented rate, with the number of individuals aged 65 and older reaching a record 36.25 million in 2024, accounting for 29.3% of the total population.2 This demographic pressure has created a "talent desert," particularly for professionals in their 30s and 40s who possess the requisite business-level English proficiency to serve as effective conduits for global headquarters.7

The Bank of Japan’s Tankan survey recently reported a diffusion index for employment conditions at -35 across all industries, indicating that labor shortages have reached their most acute point in three decades.3 While nominal wages rose by 3.5% as of April 2025, and negotiated wage increases for the year reached 5.26%, the actual pool of available candidates remains static.3 For MNCs, this means that top-tier candidates are often managing three to four simultaneous offers, leading to a "bidding war" that further extends the hiring cycle as firms struggle to align their internal compensation benchmarks with the reality of a hyper-competitive market.7

| Market Metric | Current Value (2025) | Impact on MNC Operations | Source |

|---|---|---|---|

| Unemployment Rate | 2.50% | Near-zero availability of active candidates. | 1 |

| Job-to-Applicant Ratio | 1.22 | Structural advantage for candidates in negotiations. | 2 |

| Nominal Wage Growth | 3.50% | Upward pressure on retention and offer costs. | 3 |

| Pop. Aged 65+ | 29.30% | Shrinking base of mid-career leadership talent. | 2 |

| Avg. Time-to-Fill (Exec) | 120+ Days | Extended periods of strategic stagnation. | 5 |

The Revenue Recovery Model: Quantifying the Cost of Vacancy

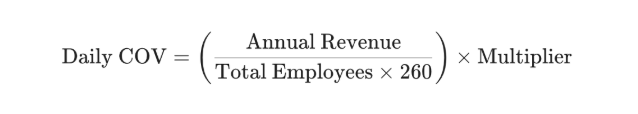

The fundamental error made by many CFOs and HR leaders is calculating the cost of an open position solely based on the direct recruitment fee or the temporary salary savings. To understand the true impact, one must utilize the Cost of Vacancy (COV) formula, which incorporates the "Average Employee Revenue" (AER) and a "Revenue Impact Multiplier" based on the seniority and strategic importance of the role.4

The Mathematical Framework for COV

The industry standard for calculating the daily revenue loss of an unfilled role involves dividing the total annual revenue of the Japanese subsidiary by the number of employees, then dividing that figure by the average number of working days (260). However, because executive roles have a disproportionate impact on the organization's ability to generate value, a multiplier must be applied.

For entry-level roles, a multiplier of 1.0 is standard. For high-impact technical or product development roles, a multiplier of 2.0 is used. For executive and leadership roles—such as those analyzed in this report—a multiplier of 3.0 is required to account for their influence over P&L management, strategic direction, and team productivity.4

Salary Savings vs. Revenue Loss: The CFO’s Paradox

While a role remains vacant, the company "saves" on salary and benefits (the latter typically costing 31.4% of the base salary in Japan).4 However, the revenue loss invariably outweighs these savings. For a Japanese subsidiary with ¥10 billion in annual revenue and 100 employees, the daily revenue per employee is ¥384,615. Applying the 3.0 executive multiplier, the daily cost of a vacant leadership seat is approximately ¥1,153,846.

| Role | Avg. Annual Salary (¥) | Monthly Vacancy Cost (¥) | 6-Month Vacancy Cost (¥) | Source |

|---|---|---|---|---|

| Country Manager | 35,000,000 | 25,000,000 | 150,000,000 | 4 |

| Sales Director | 32,000,000 | 22,000,000 | 132,000,000 | 10 |

| Finance Director | 27,000,000 | 18,000,000 | 108,000,000 | 5 |

| Marketing Director | 25,000,000 | 15,000,000 | 90,000,000 | 11 |

| HR Director | 15,000,000 | 10,000,000 | 60,000,000 | 13 |

Note: Monthly vacancy costs are rounded and based on a ¥10B revenue/100 EE model. Even at smaller scales, the ratio of cost-to-salary remains equally lopsided.

Role-Specific Analysis: The Strategic Impact of the Six-Month Void

When a position remains vacant for over six months, the organization enters a state of "atrophy." The implications are specific to each functional area, yet they collectively contribute to a degradation of the firm's market position in Japan.

The Country Manager: The Cost of Strategic Drift

The Country Manager is the ultimate steward of the MNC’s interests in Japan, serving as the bridge between global mandates and local cultural nuances.11 A six-month vacancy in this role creates a "leadership vacuum" where critical decisions regarding market entry, product localization, and regulatory compliance are deferred. This results in "strategic drift," where the Japanese office operates in a reactive mode, losing market share to competitors who are faster to innovate.7

The financial hook for this role is approximately ¥25 million per month. Beyond the direct revenue loss, the absence of a Country Manager damages long-term relationships with "Keiretsu" partners or major distributors who view the lack of a visible leader as a sign of the MNC's diminishing commitment to the Japanese market.2 In a culture where trust and continuity are paramount, the reputational cost of a six-month void can take years to repair.

The Sales Director: Unmanaged Pipelines and Quota Erosion

For the Sales Director, the cost of vacancy is the most immediate and quantifiable. In Japan’s tightening labor market, sales talent is fiercely contested. Without a Director to mentor the team, manage high-level key accounts, and set strategic quotas, the sales force often experiences a decline in morale and performance.5

A Sales Director in a major MNC typically earns around ¥32 million per year, but the revenue they influence is often ten to twenty times that amount.11 A six-month vacancy means half a year of unpursued leads and unclosed deals. Furthermore, high-performing sales professionals are the most likely to be poached by competitors if they feel their current environment lacks strong leadership or a clear path to success.7

The Marketing Director: Brand Erosion and Stalled Launches

In the life sciences and technology sectors—two of the most active hiring areas in Japan—the Marketing Director is responsible for the delicate process of product positioning in a market with unique consumer expectations.12 A vacancy here leads to stalled product launches and inefficient digital spend. With Japanese consumers being among the most demanding in the world, a lack of cohesive marketing strategy can lead to a permanent loss of brand equity.20

The cost of vacancy for a Marketing Director is roughly ¥15 million per month. This accounts for the "opportunity cost" of missed consumer trends, such as the massive shift toward AI-integrated services and e-commerce that has defined the 2024-2025 landscape.16

The Finance Director: Governance Risks and External Drag

The Finance Director role in Japan carries unique responsibilities, including compliance with J-SOX regulations and the management of relationships with Japanese megabanks.11 A vacancy in this role creates a high-risk environment. To maintain operations, firms often have to engage external accounting consultants at premium rates—typically 40% to 80% higher than the cost of a full-time executive.5

A six-month vacancy for a Finance Director costs approximately ¥18 million per month when factoring in consultant fees, potential audit delays, and the lack of strategic financial planning (FP&A) that drives operational efficiency.11

The HR Director: The Retention and Compliance Crisis

The HR Director vacancy is perhaps the most dangerous "hidden" cost. In 2024 and 2025, the Japanese government introduced significant new benefits, such as the Post-Birth Leave Support Benefit (April 2025) and expanded disclosure requirements for the gender pay gap.3 Without an HR Director to implement these changes, MNCs face not only regulatory risk but also a severe competitive disadvantage in attracting talent.

The cost of an HR Director vacancy is approximately ¥10 million per month. However, the primary cost is the "turnover culture" that develops when employees feel the organization is not investing in their growth, work-life balance, or engagement.14 The cost of replacing even one mid-level manager who leaves due to burnout during this vacancy can reach 200% of their annual salary.5

The Hidden Cost Iceberg: Burnout, Turnover, and Tacit Knowledge

While the revenue recovery model captures the direct fiscal impact, it is the hidden costs that often cause the most long-term damage to MNCs. These costs act like a "financial iceberg"—visible on the surface as recruitment fees, but massive and destructive beneath the water line in the form of organizational decay.6

The Burnout-Turnover Loop

When a leadership role is vacant for six months, the remaining staff must absorb the workload. In Japan’s already high-pressure work culture, this leads to a rapid increase in stress, fatigue, and burnout.14 Research indicates that remaining employees experience a 20% to 40% reduction in productivity due to "context-switching" and task fragmentation as they attempt to cover for the missing leader.5

This creates a self-perpetuating cycle:

- Workload Increases: The team covers the vacancy.

- Burnout Sets In: Morale drops and absenteeism increases.14

- Resignation: High-potential employees, seeing no relief in sight, accept offers from competitors who promise better work-life balance (a priority for 75% of the modern Japanese workforce).2

- Vacancy Multiplies: The organization now has multiple vacancies, compounding the daily revenue loss.5

Loss of Tacit Knowledge and Market Intelligence

In Japan, business is built on "Ningen Kankei" (human relationships). A leader who has been with a firm for years possesses tacit knowledge—the unwritten history of client negotiations, the specific nuances of a distributor’s preference, and the internal "Nemawashi" (consensus-building) required to get things done.2

When a position remains vacant for over six months, these relationship threads begin to fray. If the eventual replacement is an external hire, they must start from zero, often requiring a "ramp-up" period of 6 to 12 months to become fully productive.6 The total "time-to-value" of a hire is thus not just the time-to-fill, but the time-to-fill plus the integration period. Shortening the hiring cycle is the only way to minimize this cumulative knowledge gap.

Employer Brand Erosion and the "Desperation Premium"

The longer a role sits open, the more the market perceives it as "damaged goods." In Japan’s tight-knit professional circles, top candidates and headhunters quickly notice roles that have been advertised for over six months. This signals to the market that either the company culture is toxic, the salary is uncompetitive, or the organization is struggling.5

To overcome this negative perception, MNCs are often forced to pay a "desperation premium"—an offer significantly above market rate to entice a candidate to take the risk of joining a seemingly unstable office.5 This further inflates the cost of the vacancy beyond the daily revenue loss.

Strategic Interventions: The 90-Day Recruitment Roadmap

To stop the bleeding of revenue and morale, MNCs must treat executive recruitment as a time-sensitive strategic operation. The goal is to reduce the hiring cycle from the industry average of 120-180 days down to a 90-day "speed-to-hire" target.

Phase 1: Pre-Search Alignment (Days 1–15)

The primary cause of delay in MNC recruitment is not a lack of candidates, but a lack of internal alignment between the Japan office and the global headquarters.15 Before a search begins, all stakeholders must agree on the "Success Profile"—prioritizing competencies and skills over rigid degree requirements, which is the new rule in Japan’s tightening market.2

- Establish a "Revenue Recovery" Budget: Secure approval for recruitment fees based on the projected ¥15M–¥25M monthly loss rather than a fixed percentage of salary.

- Define the EVP: Clearly articulate the Employer Value Proposition, focusing on stability, flexibility, and the firm’s long-term commitment to Japan to counter the perception of MNC risk.2

Phase 2: Accelerated Sourcing and "Agile Nemawashi" (Days 16–45)

Traditional recruitment relies on active applicants from job boards, which accounts for a tiny fraction of the talent pool in Japan.1 Accelerated hiring requires a proactive, multi-channel approach.

- Direct Sourcing and AI Mapping: Use recruitment partners that utilize AI-powered talent mapping and social listening to identify "passive" candidates who are not actively looking but are open to the right opportunity.17

- Agile Nemawashi: In Japanese culture, consensus-building can consume 70% of a project's timeline.2 To speed this up, implement a "rolling approval" process where stakeholders at HQ provide feedback on candidates in real-time rather than waiting for a final shortlist. This has been shown to speed up approvals by 30%.2

Phase 3: High-Velocity Evaluation (Days 46–75)

The interview process in MNCs is often too long, leading to candidate drop-off as they accept faster offers from competitors.7

- Consolidated Interview Blocks: Instead of scheduling interviews over several weeks, hold "Hiring Seminars" or back-to-back interview days where candidates meet all key stakeholders, including the CEO if possible, to demonstrate urgency and commitment.8

- Competency-Based Assessment: Move away from "feeling-based" interviews toward structured assessments that evaluate a candidate’s ability to drive results in the local Japanese context.8

Phase 4: Offer, Negotiation, and Pre-Onboarding (Days 76–90)

The final stage is where many hires fail due to slow offer generation or a lack of understanding of the candidate’s current notice period and bonus structure.

- Front-Load Salary Discussions: Align on salary expectations in the first interview to avoid late-stage deal-breakers.8

- Manage the Resignation Risk: Recruitment consultants should act as career coaches, helping candidates navigate the difficult "resignation" process in Japan, where managers may use guilt or counter-offers to prevent a leader from leaving.2

Leveraging External Expertise: RPO and Retained Search ROI

For MNCs with multiple vacancies, internal HR teams are often overstretched, leading to further delays.17 Utilizing external talent solutions is not an expense but a tool for revenue recovery.

Recruitment Process Outsourcing (RPO)

RPO programs can reduce time-to-hire by 30% to 60% by dedicatedly managing the entire talent funnel.6 For an MNC, the ROI of RPO is found in the "compounding value" of faster fills.

| RPO Metric | Expected Improvement | Annual Financial Impact (Estimated) | Source |

|---|---|---|---|

| Time-to-Hire | 30% – 60% Reduction | ¥50M+ in recovered revenue | 6 |

| Agency Spend | 60% – 80% Reduction | ¥20M+ in direct cost savings | 6 |

| Manager Time | 50% – 70% Reclaimed | ¥10M+ in productivity gains | 6 |

| Attrition | 55% Reduction | ¥30M+ in avoided replacement costs | 6 |

The Retained vs. Contingent Search Paradigm

For critical roles like Country Manager or Finance Director, a "contingent" search—where multiple agencies compete to send resumes—often results in lower quality and slower fills as recruiters focus on "easy" placements rather than difficult executive searches.

A "retained" or "exclusive" search ensures that a consultancy dedicates its full resources to market mapping and proactive headhunting.2 This model is more effective for "successor presidents" or leaders who need to transition a company culture from a traditional "one-man" style to an inclusive, global approach.2 The higher upfront cost of a retained search is justified by the speed and quality of the hire, which directly correlates to the revenue recovery hook of ¥25 million per month.

Conclusions: The Mandate for Speed in the Japanese Market

The analysis of the "Cost of Vacancy" for MNCs in Japan leads to a singular conclusion: every day a leadership role remains unfilled is a day of lost revenue, increased risk, and cultural erosion. The current market reality—defined by a 2.5% unemployment rate and a chronic shortage of bilingual talent—means that traditional, slow-moving recruitment processes are no longer viable.2

To achieve revenue recovery, MNCs must adopt the following three-pillar strategy:

- Quantify the Risk: Use the 3.0x Multiplier model to present the financial impact of vacancies to global leadership. Framing a six-month vacancy as a ¥150 million loss (for a Country Manager) transforms recruitment from an HR task into a corporate priority.4

- Optimize for Velocity: Implement "Agile Nemawashi" and consolidated interview structures to reduce the hiring cycle to 90 days. In a market where top talent is interviewed by multiple firms, speed is the ultimate competitive advantage.2

- Invest in Quality: Focus on "time-to-productivity" rather than just "time-to-fill." This requires deep market intelligence, structured onboarding (30-60-90 day plans), and the use of specialized search partners who understand the nuances of the Japanese talent landscape.2

The recovery of revenue begins with the recovery of leadership. By shortening the hiring cycle and minimizing the "vacancy drag," MNCs can ensure their Japanese operations remain resilient, profitable, and capable of long-term growth in an increasingly challenging demographic environment. For the modern MNC in Japan, the most expensive hire is not the one with the highest salary, but the one that was made six months too late.

Works cited

- Job in Japan: Ultimate Salary Guide for Foreigners & Japan Dev Tips | E-Housing, accessed January 11, 2026, https://e-housing.jp/post/job-in-japan-ultimate-salary-guide-for-foreigners-and-japan-dev

- The New Rules of Recruitment in Japan's Tightening Labor Market, accessed January 11, 2026, https://www.makanapartners.com/the-new-rules-of-recruitment-in-japans-tightening-labor-market

- OECD Employment Outlook 2025: Japan, accessed January 11, 2026, https://www.oecd.org/en/publications/oecd-employment-outlook-2025-country-notes_f91531f7-en/japan_7672bd00-en.html

- Cost of Vacancy: Calculate the Cost of Open Roles | Built In, accessed January 11, 2026, https://builtin.com/recruiting/cost-of-vacancy

- Cost of Vacancy: Measuring the Impact of Open Roles - Advanced RPO, accessed January 11, 2026, https://www.advancedrpo.com/resources/cost-of-vacancy-framework-for-measuring/

- The True ROI of RPO: How Outsourcing Recruitment Saves Money and Time - Serendi, accessed January 11, 2026, https://www.serendi.com/post/the-true-roi-of-rpo-how-outsourcing-recruitment-saves-money-and-time

- Japan's 2025 Hiring Market: Key Insights - Executive Search in Japan & APAC, accessed January 11, 2026, https://ryze-recruit.com/en/japan-2025-hiring-market-key-insights/

- Why mid-career hiring is challenging in Japan and how to overcome it - Robert Half, accessed January 11, 2026, https://www.roberthalf.com/jp/en/insights/hiring-help/difficulties-in-mid-career-recruitment

- Average Time To Fill By Industry 2025 - Corporate Navigators, accessed January 11, 2026, https://www.corporatenavigators.com/articles/recruiting-trends/the-average-time-to-fill-by-industry-in-2024/

- How to Calculate the Cost of Vacancy for Open Roles - DISHER Talent Solutions, accessed January 11, 2026, https://dishertalent.com/blog/calculate-cost-of-vacancy/

- Highest-paying jobs in Japan: Top 10 in 2025 | Michael Page, accessed January 11, 2026, https://www.michaelpage.co.jp/en/advice/market-insights/highest-paying-jobs-japan

- Hays Salary Guie Asia 2025 | PDF | Employee Retention | Employment - Scribd, accessed January 11, 2026, https://www.scribd.com/document/845453526/Hays-Salary-Guie-Asia-2025

- Tokyo Senior HR Executive Market Analysis Leadership Talent Japan - Makana Partners, accessed January 11, 2026, https://www.makanapartners.com/the-tokyo-senior-hr-executive-market-a-comprehensive-analysis-of-leadership-talent-in-japan-s-multinational-corporations

- http://ijrcm.org.in/ - ResearchGate, accessed January 11, 2026, https://www.researchgate.net/profile/Khawaja-Rahman-2/publication/367341144_3_IJRCM/links/63ce7196e922c50e99bafc26/3-IJRCM.pdf

- Understanding the Japan Talent Market - Spencer Stuart, accessed January 11, 2026, https://www.spencerstuart.com/research-and-insight/understanding-the-japan-talent-market

- 2025 Japan's Top Ten Talent Trends, accessed January 11, 2026, https://www.hays.co.jp/en/japan-top-ten-talent-trends_2025

- How recruitment agencies in Japan cut your hiring time and secure top talent | Michael Page, accessed January 11, 2026, https://www.michaelpage.co.jp/en/advice/management-advice/hiring/cut-hiring-time-secure-top-talent

- Sales Director – Credit, Risk, Analytics, and Digital Solutions, accessed January 11, 2026, https://svarecruitment.current.jobs/job/sales-director-%E2%80%93-credit,-risk,-analytics,-and-digital-solutions-provider-mnc-%E2%80%93-20m-jpy-annual-802.aspx

- Stress and Turnover Intents in International Organizations: Social Support and Work Life Balance as Resources. | Request PDF - ResearchGate, accessed January 11, 2026, https://www.researchgate.net/publication/309292452_Stress_and_Turnover_Intents_in_International_Organizations_Social_Support_and_Work_Life_Balance_as_Resources

- The copyright © of this thesis belongs to its rightful author and/or other copyright owner. Copies can be accessed and downloa - UUM Electronic Theses and Dissertation [eTheses] - Universiti Utara Malaysia, accessed January 11, 2026, https://etd.uum.edu.my/7899/1/s821800_01.pdf

- ISCA Salary and Career Snippets Revelation 1 - Singapore, accessed January 11, 2026, https://isca.org.sg/docs/default-source/career-growth-centre/isca-salary-and-career-snippets-revelation-1.pdf?sfvrsn=b9e3aca4_26

- KSA & UAE Salary Survey 2025 | PDF | Employment | Financial Analyst - Scribd, accessed January 11, 2026, https://www.scribd.com/document/843459500/KSA-UAE-Salary-Survey-2025

- UNI Europa Literature Review: Labour Shortages and Turnover in Industrial Cleaning, Long- term Care and Private Security (VS/2019/0292), accessed January 11, 2026, https://www.uni-europa.org/wp-content/uploads/sites/3/2022/06/Literature-review_-v3.pdf

- the relationship between human resource management practices and turnover intention in a manufacturing - UUM Electronic Theses and Dissertation [eTheses], accessed January 11, 2026, https://etd.uum.edu.my/5188/1/s811914.

- 30-60-90 Day Plan: 2024 Complete Guide + Templates - Guru, accessed January 11, 2026, https://www.getguru.com/templates/30-60-90-day-plan